Buyers, Sales, Income: Vertical Markets in Electronic Industry Supply Chains - August 2024

Below are some recent thoughts and opinions on what I'm seeing in industry based on client work and feedback from discussions with electronics hardware and equipment manufacturers and investors.

For equipment manufacturers in the range of $250 million to $10 billion income, many of these hardware manufacturers are focusing on product revisions instead of costly new product introductions. For others, their manufacturing NPI programs have not slowed down.

Some of the reasons I see for focusing on product revisions include tightening credit markets (banks less willing to lend) for an increasing number of manufacturers against market and economic forecast uncertainty when weighing hardware new product costs against market risks - real possibility of wasting valuable, hard-earned income (cash) on new product launches that could fail.

The ROI on NPI hardware launches is not always a clear path.

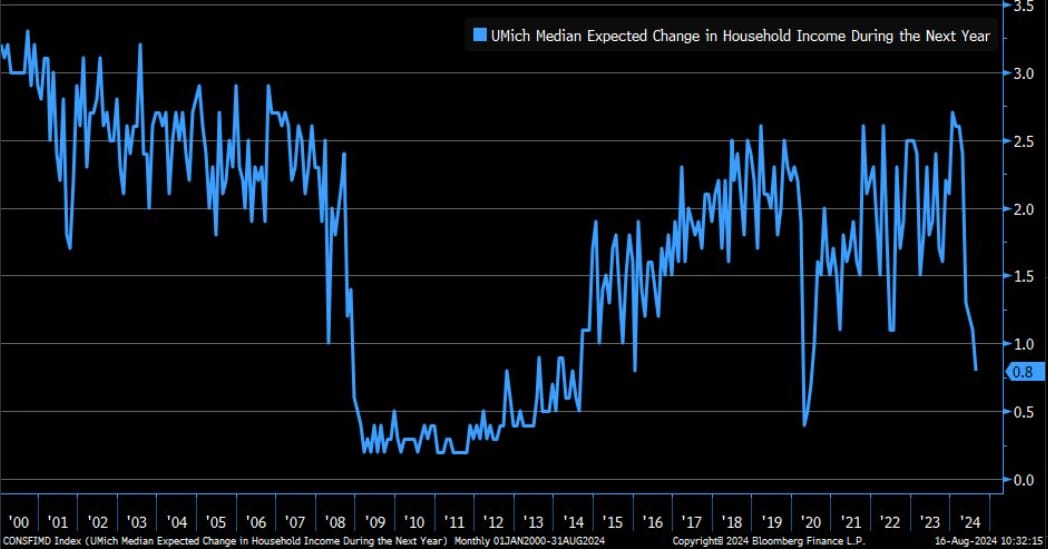

Another reason not to be ignored is declining consumer confidence in household incomes. This has a direct impact on consumer discretionary spend - available cash after living expenses and household bills are paid.

Less money for households to spend can impact sales of consumer electronics durable goods which includes appliances like refrigerators, washers and dryers, air conditioners, computer and monitors, televisions, tools and, other electronics.

Durable electronics goods includes companies like Whirlpool, BSH Home Appliances, GE, Milwaukee Tools, HP, Dell, Caterpillar, Carrier, Haier, Western Digital, to name a few.

As some economic headwinds take shape in different industries and vertical markets manufacturers will continue their best efforts to retain customers and marketshare.

Manufacturers who can successfully engineer product revisions are adding variability and increased functionality. This is accomplished by adding daughter cards and granddaughter cards to systems and assemblies, offering more sub-assemblies to enhance product functionality, releasing options for different motherboard specs, different components...

With additions of new, and more, circuit cards to systems it is not surprising to also see this increased demand for cable assembly and wire harnesses work orders and programs - which has been happening for some time. The challenge for EMS manufacturers offering these services is proper pricing and PPV since tooling costs can be limited to a specific customer's program.

Meanwhile, plans by equipment manufacturers to launch new products into non-traditional markets like aerospace and defense, industrial and medical electronics...show fewer signs of slowing down.

These non-traditional manufacturing industries also have higher margins, on average, when properly managed and they can have more reliable income opportunities (like government defense contracts) when serving the right buyers and industry markets.

To underscore this interest in non-traditional manufacturing, and manufacturing services and factories, limited partner investors and private equity firms remain interested in acquiring manufacturers.

This is interest is growing beyond investors and the manufacturing middle-market. Savvy manufacturers with cash are also eyeing to scoop up distressed manufacturing; stepping in to often purchase new equipment and buildings in some softening manufacturing markets to strengthen their own capacity and manufacturing supply chains.

Some brighter spots in the electronics industry supply chain include companies making adhesives, resins and composite materials. While some vendors and suppliers providing these products and services are seeing budget caps or, a single-digit, percentage increases in the amount spend they have for next year's budget, other vendors and supplier in these industries are more fortunate.

Supply chains for these vendors and suppliers include companies with proprietary processes supported by good procedures, a strong sense of urgency and accountability and stand-out making adhesives, resins and composite materials.

Companies making adhesives, resins and composite materials includes firms like Henkel, 3M, BASF, Toray, Hexcel...

Some of these companies are frequently capturing opportunities to increase margins and grow income in new vertical markets.