Mad Rush to Create Technology Manufacturing Ecosystems to Attract Income and Tax Receipts

As Trump tariffs take shape and nations begin erecting trade barriers many manufacturers wanting to access the US market economy are tariff-hopping for competitive supply chain positioning. The US will become the primary creditor nation on the world stage. I also believe this will continue into 2027 while more M&As occur for these companies, especially European manufacturers, to acquire or JV additional capacity and facilities in the US - further supported by US states offering M&A incentives and the Trump administration's promise to streamline US investment with fewer and/or expedited circumventing some US regulations.

This US M&A trend is particularly noteworthy for European manufacturers wanting to expand in US markets as many are facing deteriorating economics. As the march toward war progresses in Europe I also see capital controls possibly restricting or limiting outward-bound capital so European companies must move quickly. Acquiring manufacturers with cash are most-suited and finding distressed production facilities and operations, often picking up factory square footage and nearly new equipment.

This evolving global M&A trend is occurring while some foreign manufacturers and their governments are also focusing interest internally, trying to create local and regional manufacturing hubs to and create their own market economies for increasingly scarce domestic (and foreign) income and tax receipts necessary to support local and regional commerce and fund budgets for different levels of government. Read more on M&A trends and strategy below.

In this spirit of creating local and regional manufacturing hubs, nations must attract 1000s of often foreign, vendors and suppliers (and many from the US) needed to do this. For manufacturing destination places like Thailand, Vietnam and other South East Asia locations...manufacturers are primarily interested in making things for European and US markets, depending on the product, because they do not have a strong market economy for internal consumption. This includes manufacturers in India although India has other shortcomings the nation has been trying to address. See article below I wrote a few years ago for Gateway House - Indian Council on Foreign Relations, a think tank located in Mumbai. Since then India has made some progress but major challenges remain.

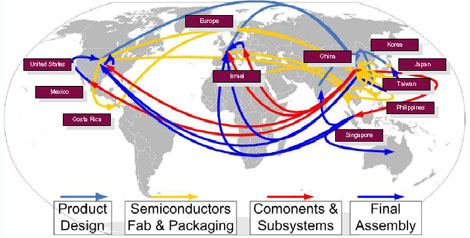

And while many foreign manufacturing destinations might already have a decent electronics manufacturing supply chain ecosystems, one primary roadblock I often see is many larger vendors and suppliers are concerns about their proprietary systems (IP protection) used for tracking orders and inventory, sales and operations planning...

For the US to become a highly competitive manufacturing destination US policy-makers will have to address corporate tax rates and create more favorable US labor workforce tax rates, which, contrary to what most people think, were the primary drivers for US manufacturing to move offshore starting in the 1950s.

For European manufacturers facing increasing uncertainty with sales orders and income this article contains several resources and options.

_________________________________________________________

About

What matters when formulating contract electronic strategy? How do you identify supplier profit centers and what are you doing to protect against margin erosion for your outsourcing programs? Why do provider capabilities often not match capabilities they claim? How are you benchmarking your supply chain against competitors?

I’ve spent 25+ years in contract electronics industry setting up contract electronic divisions and running operations, protecting EMS program profits, manufacturing capacity M&A and more. I run a technology solutions firm. A lot of times this means asking the right questions.

_________________________________________________________