Microprocessors Drive Electrical Product Design Decisions But Inadequate Industrial Search Engines Prevent Cost Efficiency

Electronics design teams still routinely face one key problem evading the industrial search engine platforms that EEs, designers and hardware equipment companies tend to rely on for success.

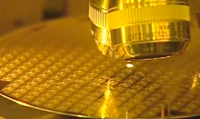

Selecting the proper microprocessor is one the earliest decisions when designing electronics hardware equipment. It's from this decision all other new product development decisions are made.

Everything else like power supplies and batteries, charging technologies and quality certification decisions are further downstream. Buses, memory - DRAM, flash ...

Electrical engineers (EE) don't have a desire or the ability to appreciate what electronic engineers often think about - things like configuring sheet metals and mechanicals, hardware systems assembly design or how to find solutions to questions like; how is software going to marry with hardware?

From the deepest level where creating originates EEs are already thinking about understanding data sheets and asking, should I be thinking large or micro processor?

EEs want to understand systems requirements, transactions processing per second, BUS connections... stuff like this.

You're also thinking about product performance, features and functions - knowing that design and testing are closely related to making sure high-level protocols can execute. Decisions about processing, memory selections and sub-systems are all related.

Ultimately, you know hardware needs software to run on your system. And, after confirming everything up to this point occurs as you want, you then look for how to improve your overall system. You may do 1000 packets per second but marketing and performance specs need 5000 specs per second. You get the idea.

But successfully navigating electronics product development also means your product is competitively priced.

Every electronic product design engineer knows costs for changes in electronics product development rise considerably as you approach full production demand. And its because of this EEs can become invaluable to corporate decision-making when discussing feasibility to enter new market verticals - breaking in, and creation.

Industrial search engines vs BOM cost optimization

Offering competitive products and pricing to your market(s) is desired outcome for every electronic hardware and equipment company. Procurement knows optimizing your BOM is part of this. But finding true electronics components availability, best quantity and best pricing is not what it appears when you look deeper.

Enter the industrial search engine.

From identifying and maintaining technically-approved industrial sourcing databases for assigned electronic control units (ECU), to comparing accurate EE BOMs for product cost analysis, electronics design teams still routinely face one key problem evading the industrial search engine platforms you tend to rely on, but is necessary for your success: business objectives for original equipment manufacturers (OEM) are not aligned with incentives chased by contract electronics manufacturing services (EMS) providers and components distributors that use these industrial platforms.

Maintaining alignment between microprocessor performance specs and desired hardware functionality and features manufacturer want for best product-market positioning is only part of the manufacturing enterprise decision-making process.

It's also important for cost and make vs buy decisions when considering EMS manufacturers to help lower your total landed cost.

But here is where industrial search engines often fall short. Plus, automated quote pricing in these engines, while saving time, do little to help equipment manufacturers build trust in their supply chains.

This is because developing new electronics product features can be meticulously focused on individual target user groups and business-use-cases, say, coming from all departments supporting production manufacturing, and industrial search engines are lacking in this knowledge.

In talking with electronics industry; hardware designers, manufacturing supply chain managers, components distributors and analysts plus some non-OEM components manufacturers - names like Nvidia, Texas Instruments, Intel ... you quickly find these groups each prefer different industrial search engines depending on what they're looking for or need.

Industrial search engine use cases

Depending on the user some industrial search engine use cases include:

- Perform and review worst case analysis using evolution visualization for architectures (EVA) on new architecture ECUs

- Schematic reviews on new architecture ECUs

- Component selection and analysis on both active and passive components

- EE BOM comparisons for cost analysis

For technical specialists industrial search engine use cases can include:

- ECU hardware partnership development

- Maintaining a technically approved supplier sourcing database for assigned ECU’s

- Identifying and documenting technical capability assessment questions for better ECU supplier sourcing

- Develop and maintain ECU sourcing calendar to be used cross functionally for supplier sourcing activities

- Assist in the architectural or hardware development of ECU’s when requested

- Assist in identifying high level software BOM for microcontrollers (MCU) and system-on-chip (SoC) as well as hardware interface technique to IO port (HWio) requirements

- Identify ECU assembly sequence and requirements for sourcing documents

- Refine how a supplier’s ECU manufacturing capabilities are assessed cross-functionally

You also find out industrial search engines do not really help with accurate visibility and they offer only negligible, to no, helpful project planning. Engines offer pricing and 'availability' on components - which is limited to what a distributor wants to reveal and is impacted by whatever side deals a distributor might have with various quoting platforms.

The truth remains, industrial search engines are purposefully designed to drive income to manufacturing quoting software platforms, distributors and EMS companies - not find best pricing for electronics OEM hardware equipment companies.

Engine users can identify and select or prioritize distributors, set pricing thresholds and prioritization, categorize custom groups of vendors for you to search by. Some will even allow you to network and source with other, third-party vendors and suppliers. So, not only can you search Arrow, Avnet, Digi-Key... you can also identify other suppliers through your search.

This is not to say industrial search engines do not provide value. They do. The value provided depends on whether the user is using the proper search engine based on their need. Below are just a few of the many different industrial search engines.

Findchips

SupplyFrame, which was acquired by Siemens, also owns Findchips. Findchips' focus is electronics OEM brand companies and manufacturing decision makers, EEs and production-run design houses.

Findchips can compare prices for users across multiple components distributors and users can set alerts for inventory updates or price changes. Findchips aggregates data from global distributors, offering a broad view of component availability.

Findchips disadvantages

Findchips is limited to pricing and availability - focusing mainly on price comparison and offers users less depth in product data or design resources, making Findchips not ideal for design engineers needing design tools, application notes, or in-depth technical documentation.

Findchips user interface also lacks advanced features and BOM tools and upload features are also weak.

Octopart

Octopart is focused on prototyping for both EEs, mechanical engineers, electronics designers, both hardware and software - ranging from serious prototype and NPD specialists to hobbyists and students working on their capstone projects plus a broader audience now that Octopart added MRO distributor pricing and availability to their engine.

Octopart also offers datasheets and BOM tools for uploading and checking inventory availability and pricing plus, API integrations for direct internal Company website searches.

Octopart disadvantages

Octopart is limited primarily to electronic components. This makes it less useful for engineers working with non-electronic industrial parts. The Octopart platform can also seem more complex for casual users since there is so much information available and hobbyists and engineers with less experiences may not easily find their way around the platform.

Octopart's focus on electronics components also means the platform is less helpful for users seeking non-electronics components used in electronics products, but fall outside of the electronics category or industry.

TrustedParts

TrustedParts, operated by the ECIA – Electronic Components Industry Association), focuses only on authorized distributors. It's aim is to minimize counterfeit risk. TrustedParts also aggregates verified inventory and pricing data. It's competitive in professional or enterprise settings where supply chain trust is more urgent. It's become a good alternative to broader aggregators like Octopart.

TrustedParts disadvantages

TrustedParts shows far fewer alternatives to parts on their system because it excludes independent brokers, excess inventory houses, and sources that are not authorized. There is also nearly zero coverage of EOL or obscure parts – these typically only found in broker / excess markets.

SiliconExpert

SiliconExpert is focuses on product lifecycle planning and supply chain risk mitigation with emphasis on design standards. Not a real industrial search engine like Octopart and Findchips.

SiliconExpert offers various solutions like BOM management and alerts plus other services tailored to several different market verticals. Solutions and services galore.

SiliconExpert disadvantages

Lots of information to navigate behind an awkward interface that does not live up to its claims of lifecycle management. Market positioning on components obsolescence and end-of-life status are two improvement opportunities. There is more value than how its presented if you know what you want.

More to be desired

In additional to the search engines and features mentioned in this article there are many more industrial platforms and features for users to choose from. Some platforms allow EMS manufacturers to grant components distributors website log in credentials so specific software in these platforms can quote EMS hardware projects for OEM customers.

From a quoting perspective for hardware and equipment programs sourced with contract EMS manufacturers, none of the quote software platforms and none of the industrial search engines can effectively determine accurate costs v pricing when partnering with contract EMS services.

EMS manufacturing quoting platform development and features capability is driven by electronics OEM equipment supply chains requiring a greater level of visibility and supply chain management.

Some engines can track your BOM searches and save product lifecycle management data. For example, when EMS companies are required by customers to track availability for particular components across your expected product lifecycle, some of these platforms can even send you reports .

Accuracy and speed are the most basic requirements every industrial search engine user wants. Ultimately, users want to trust component pricing for a quote and have it within a few minutes.

OEM equipment firms requiring their EMS partners to offer greater supply chain management are asking EMS providers to communicate acknowledgement of the OEM's requirements presented, followed by demonstration in the EMS provider's system, beyond just acknowledging.

OEMs want to trust, but verify, what this looks like internally for the EMS provider prior to execution.

And while accuracy and speed are important BOM pricing based on real availability against honest demand should be normal expectations for any electronics OEM brand bringing new products to market or wanting to locate best pricing to reduce costs re-designing existing hardware equipment.