MZ Weekly Thread for February 3, 2025

Impact of Trump tariffs on Mexico and Canada, foreign manufacturer tariff-hopping, U.S. state-by-state export partners highlighting strategic relationships across borders and overseas, foreign currencies.

Many reading this week's newsletter will remember when President Trump threatened John Deere in September 2023 saying he would slap a 200% tariff on John Deere imports into the United States if the company moved production to Mexico as planned.

John Deere pulled back.

This public move by Trump was more than a threat. It sparked a repatriation of manufacturers looking for ways to bring manufacturing back to U.S. soil.

February began the month with Trump imposing U.S. tariffs on China, Mexico and Canada. This newsletter focuses mainly on Mexico and Canada.

Today, Mexico exports $421 billion [chart below] worth of goods and services (35% of its GDP) to the U.S., but the U.S. only exports 1.2% of our GDP to Mexico. What happens when 1.5% of the items the U.S. purchases from Mexico are increased by 25%? Most of the U.S. population won't even notice.

However, in Mexico if 35% of it's exported products produced for Mexico's GDP suddenly get a big increase in tax (tariffs) Mexican consumers will immediately feel the pinch.

_________________________________________________________

About

What matters when formulating contract electronic strategy? How do you identify supplier profit centers and what are you doing to protect against margin erosion for your outsourcing programs? Why do provider capabilities often not match capabilities they claim? How are you benchmarking your supply chain against competitors?

I’ve spent 25+ years in contract electronics industry setting up contract electronic divisions and running operations, protecting EMS program profits, manufacturing capacity M&A and more. I run a technology solutions firm. A lot of times this means asking the right questions.

_________________________________________________________

US import companies importing products from Mexico and Canada into U.S. markets will pay tariffs (tax) to Mexico and Canada which will raise prices on those products for U.S. consumers.

Below, 2023 figures for U.S. imports, by category, from Mexico totaling $475 billion. Several of the following charts were created by Robert Sterling on X @RobertMSterling. Sterling created the charts by downloading and analyzing "a bunch of Trade Department data."

Sterling used U.S. government HTS codes to identify categories for charts for both Mexico and Canada.

Mexico's automotive industry will not go unscathed. In 2024 almost 22% of new cars sold in the U.S. were built in Mexico.

As for Mexico's automotive industry, "Nearly every auto OEM—GM, Ford, VW, Toyota, Nissan, and others—has operations in Mexico, thanks to NAFTA/USMCA," writes Sterling, on X.

Below, Sterling trends trade imbalance ($B) between U.S. and Mexico 2012 to 2023.

Canada is in a similar position as Mexico. Below Sterling looks at U.S. imports from Canada totaling $418 billion in 2023.

Canada exports 22% of its GDP to the U.S., but the U.S. only exports 1.5% of its GDP to Canada. When Canada places tariffs on Canadian goods destined for the U.S. it will be on such a small amount of goods most of the U.S. population will not notice. Below, U.S. trade balance with Canada.

Neither Mexico nor Canada has any leverage to negotiate tariffs with the U.S.. Meanwhile, it's also clear the U.S. does not place too much reliance on U.S. exports to Mexico or Canada. You can see below economies for both Mexico and Canada rely heavily on their goods reaching U.S. markets.

Looking more closely at trading partners by U.S. state, below, you can see the biggest export partner for each U.S. state via Business Insider.

What's next?

Governments are expensive to run. U.S. Treasury sales and tax receipts paid by corporations and individuals are primary drivers of U.S. government income today. But this was not always the case.

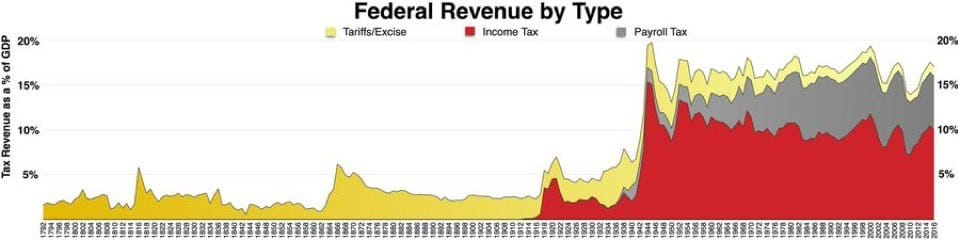

“For most of our country’s history, the federal government was funded by tariffs, there was no income tax, the budget was (mostly) balanced, and federal spending was less than 10% of GDP. Tax receipts and selling have been a major driver”, says Thomas Massie, member of the U.S. Congress representing the 4th District of Kentucky on X @RepThomasMassie.

U.S. tax collections began in 1913 with the Revenue Act of 1913, also known as the Underwood Tariff or the Underwood-Simmons Act.

The chart below shows U.S. government Federal revenue, by type, for tariffs and excise, income tax and payroll tax. It's a little hard to read the x axis.

Tariffs begin with the inception of the Federal Reserve. U.S. income tax began in 1913-14, with a small percentage, then surging heading into World War II. As corporate taxes ate into U.S. manufacturer profits manufacturing and manufacturing jobs started going overseas in the 1950s. U.S. companies were finding it difficult to be profitable. Today, some of that manufacturing is reshoring.

Nobody knows how President Trump's tariff policies will play out. It could take years for some U.S. tariffs to reveal their full impact. Trump is even talking about using tariffs to replace income tax. I think there is a good chance U.S. tariffs on Mexico and Canada may be short-lived.

As local, regional and global manufacturing supply chains undergo changes I see growing interest from manufacturers wanting to benchmark competitor supply chains. I am also seeing more manufacturers acquiring new capacity or moving production to the U.S. as tariff-hopping finds more favorable ways for foreign firms to reach U.S. consumers.

And what if Trump's tariffs are not short-lived and last years?

In the long run I think tariffs will raise prices for some goods in U.S. markets and one benefit will be manufacturing jobs returning to the U.S. and I believe most Americans will be happy with that even if they have to pay 20% more for some goods.

Alternatively, foreign currencies will weaken considerably against a rising dollar and if this happens demand for U.S. goods and services from other nations could contract and U.S. companies could see softening demand leading to a U.S. recession.

According to Peter Schiff, chief economist and global strategist at Europac on X @PeterSchiff, "the U.S. service sector economy depends on low-cost imports to survive. Anything that increases import prices can potentially prick the bubble."

During Trump's first trade war U.S. government tax receipts rose substantially.

Trump's current trade war combined with Elon's cost-cutting could translate to a healthier U.S. government bond market.

Share and subscribe

Thank you for reading. If you found this article useful or interesting, feel free to share it with others.