Port Strike! USMX Maritime Logistics vs Touch Fees Paid to IRL as Manufacturing Supply Chains Suffer

At 12:01 on Tuesday October 1, 2024 tens of thousands of dockworkers with the International Longshoremen's Association (ILA) acted on their threat to strike. "USMX brought on this strike when they decided to hold firm to foreign-owned ocean carriers earning billion-dollar profits at United States ports, but not compensate the American ILA longshore workers who perform the labor that brings them their wealth," said ILA President Harold Daggett in a statement posted on social media.

The dispute is with the ILA's union agreement with the United States Maritime Alliance (USMX), a shipping industry group representing port and terminal operators and ocean freight and cargo shipping container carriers.

USMX has 13 members on its board. There are three direct port employees, three represent port associations in the United States, and to Harold Daggett's point, there are seven shipping firms represented which are each foreign-owned: Evergreen (Taiwan), Ocean Network Express (Japan), Hapag-Lloyd (Denmark), Maersk (Germany), CMA CGM Group (France), Mediterranean Shipping Company (Switzerland) and COSCO (China).

The last time ILA elected to strike was in 1977.

Meanwhile, according to Craig Fuller on X and founder at FreightWaves.com, a freight-related media resource and service, "If you want to blame anyone - it’s the Box Club and the massive consolidation of global container shipping companies - a cartel. The top 10 container ship lines have 90% market share. Not a single one based in US", says Fuller.

What's at stake?

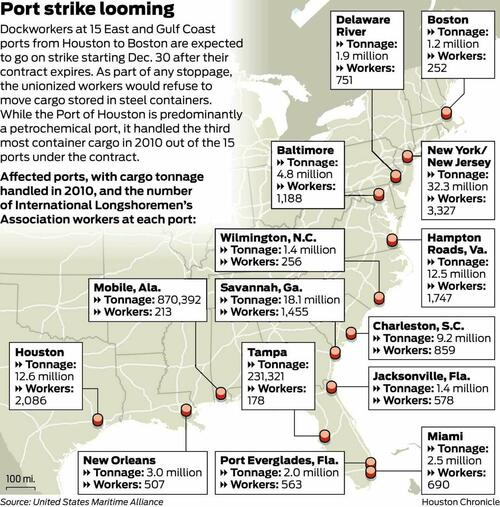

Houston Chronicle graphic below displays USMX data showing the busiest US East and Gulf Coast shipping ports with number of workers and tonnage moved.

Some of the top US importing companies through the East and Gulf Coast ports include Walmart, Ikea, Samsung, Bob's Discount Furniture, LG, Home Depot, Continental Tire, Hyundai, General Motors...to name a few according to Arbor Data Science.

"Neither side wants a deal", according to a post on X by John Konrad, a former ship captain, maritime journalist, author of Fire On The Horizon: The Untold Story of the Gulf Oil Disaster and CEO at gCaptain.com, which is the world's top-visited maritime and offshore industry news website. "The ILA wants unreasonable demands and can afford to hold out. USMX shipowners have learned that port congestion increases rates and boosts profits", says Konrad.

Konrad also notes that one of the USMX board members - the COSCO shipping representative - is under direct control of the CCP. "Because China is such a dominant exporter of both goods and ships, most other members of USMX are under great pressure to comply with China’s instructions."

Konrad goes further to say "Neither side will admit this publicly but a strike would be a huge leveraging chip against possible tariffs."

Ship owners do benefit from strikes because reduced capacity can demand higher shipping container transport rates.

Automation or job security?

In addition to interest in higher wages, the ILA also wants some reassurances against automation at ports. Meanwhile, China has already automated its port in Guangzhou, according to American journalist in China, Jason Smith on X.

Without knowledge how long this strike may last companies are already circling the wagons, trying to exploit opportunities and plan defenses for their supply chains.

One rule of thumb is that for each strike day it takes nearly a week to get ports operating at normal levels according to an article by Jeff Cox with CNBC.

“The costs of the strike would escalate over time as backlogs of exports and imports grow,” Citigroup economist Andrew Hollenhorst said in a client note. “If the strike extends beyond a few days, shortages of certain production inputs could eventually slow production and raise prices for manufactured goods like autos.”

Primary East coast ports for vehicle industry imports are Ports of New York and New Jersey behind #1 Ports of Los Angeles and #2 Long Beach which stands out as a prominent car shipping hub.

Port touch fees pad ILA coffers

While most stories with focus on workers losing jobs and gain sympathy among users, the ILA refusing automation isn’t the real story, according to Konrad at gCaptain.

Konrad writes on X, "The craziest ILA demand is touch fees.

Let me explain…

You’ve heard about our crumbling highways and bridges? And the $1.2 TRILLION infrastructure bill Congress passed to fix them? Well, the primary culprit for that damage? Heavy loads.

The rest of the world gets it. They offload containers onto barges or feeder ships to save their roads and reduce fatalities. It’s called short sea shipping.

Europe: Big ship arrives ➡️ 🏗️ moves container ➡️ terminal ➡️ 🏗️ onto a barge ➡️ barge sails to a smaller port ➡️ 🏗️ onto a truck ➡️ short drive to warehouse.

That’s 3 crane touches

US (ILA ports): Big ship arrives ➡️ 🏗️ moves container ➡️ truck 🚛 drives hundreds of miles.

That’s 1 union crane touch

Why? Because every time the union crane touches a container, the union rakes in a massive fee.

So it’s somehow cheaper to truck containers hundreds of miles and let taxpayers foot the road repair bill than let the union touch it two more times for short sea shipping to work."

The net of the situation: the higher the number of 'touches' US ports perform to offloading containers, whether the 'touch' is from a human or robot, yields more fees paid to the IRL.

Furthermore, gCaptain's Konrad asks on X, "Why isn’t MSM asking truckers and ship captains what they think about the ILA’s no-automation demands?

As more information becomes available it appears the strike is not primarily about automation and job security and wages for workers. The strike and ensuing union contract negotiations appear to be more about maintaining touch fees USMX paid to the IRL.

Nonetheless, every electronics manufacturing company I've talked with the past month has mentioned concern about a possible strike and now that it's here, minimizing manufacturing supply chain disruption and sharpening pencils to manage or reduce manufacturing supply chain costs will be even more important as some analysts predict the strike could cost the American economy $1 billion to $5 billion per day.