Questions to Guide EMS Manufacturer Supplier Development, Accountability and Supply Chain Visibility

Below are some questions asked by OEMs during recent costing labs. Labs accompany training for clients using my costing modeler which determine internal EMS factory program cost vs quote pricing presented to OEM customers. Modelers help OEMs during contract negotiations for fees paid to EMS providers.

My modelers also identify optimal EMS program total landed cost, program ROI, materials exposure and currency risks, plus a lot of other concerns companies have with working with EMS manufacturers.

I am sharing some of these questions with my newsletter subscribers below.

Some questions were re-phrased. Questions are divided into questions OEMs are asking internally, while other questions are directed at their EMS partners.

OEM questions to ask EMS manufacturers

How are you determining supply chain buffer inventories held on-site EMS manufacturer?

How are you calculating 'optimal' costs of materials, rates, markups and formulas when quote pricing our program?

How are EMS inventory turns being measured?

How do you verify you are not using inaccurate or incomplete operating input costs when calculating quote pricing for our program?

What procedures or guidelines do you use to prevent your buyers from double ordering to cover poor, or improper, decision-making inside your company?

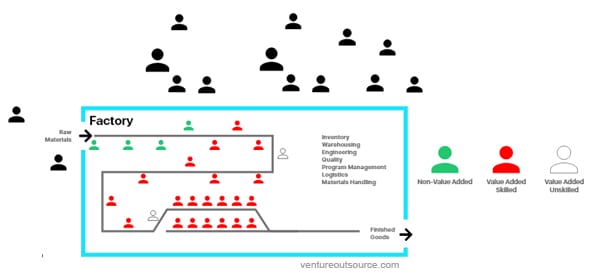

How are you managing internal EMS labor workforce costs, timeliness, and productivity execution for costly EMS indirect labor staff supporting our programs?

How do your procurement and purchasing-specific activities manage against excessive materials pipelining for our supply chain that otherwise offsets poor EMS provider planning for our programs?

How are you managing country-of-origin (COO) and UNSPS code management, HTS codes accuracy and other compliance issues where penalties, customs delays? (Because having to restate manufacturing quarterly financials can be costly. Are you paying attention 'tariff hopping'?)

How do you hold EMS provider procurement functional groups accountable that support our programs - to drive our program materials scrap to zero, eliminate excess and obsolete materials, and reduce need for 'scrapping' that EMS manufacturers often do to close incomplete work orders?

How are your internal sales and operations planning (S&OP) steps prioritized to identify and flag inconsistencies with work orders for my programs to eliminate material shortages and production stoppages through end-of-life product lifecycle management?

How are you managing inventory exposure - on a BOM line-item basis - at any given point in my program production workflows in your factory, such as work-in-progress (WIP) for any given board, sub-assembly or top-level tested and finished good assembly?

What are you doing to remove data silos for better access to the same, dependable vendor and supplier data needed by your departments for faster and more accurate decision-making to support our supply chain?

How are you calculating optimal ex-factory target price (total landed cost) for my program against your costed BOM quoted pricing you quoted us?

Internal questions for OEM teams

How can we use costing and modeling to better forecast and monitor our EMS program costs against budget constraints and objectives?

Are our contract manufacturing service agreement more focused on 'legalize' or operational supply chain issues that more likely to have real material impact on our supply chain's ability to server our customers?

How do we break out key design costs for our program's quoted pricing prepared by ODM manufacturers?

How do we predict and adjust for tiered volume pricing when negotiation contract SLAs with EMS manufacturers?

How do we use the cost modeler to address contract clauses for currency exposure against raw materials, warehousing, product change notices, production WIP and FGI against different geographies?

What triggers are used to determine when buffer inventory on our EMS manufacturer's books is transferred to our books?

How can we recognize which EMS manufacturing internal quote pricing constants or inputs need updating?

How do we attribute the direct impact of specific EMS provider pricing constants to upside and downside changes in our materials spend with EMS manufacturers we work with?